Insurance is an essential part of life in South Africa, offering protection and peace of mind against unexpected events. Whether it’s safeguarding your family, health, travels, or vehicle, having the right insurance ensures you’re financially prepared for emergencies.

This article focuses on four key types of insurance:

- Life Insurance: Provides financial support to your loved ones in case of your death. Explore the top life insurance options in South Africa.

- Health Insurance: Covers medical costs and helps you access quality healthcare. Learn more about health insurance in South Africa.

- Travel Insurance: Protects you during trips, covering things like cancellations and emergencies. Find the best travel insurance in South Africa.

- Car Insurance: Offers coverage for accidents, theft, and damages to your vehicle. Check out the best car insurance in South Africa.

Understanding these categories can help you make informed decisions to secure your future.

Top Life Insurance Options in South Africa

Life insurance is a financial safety net that provides money to your loved ones when you pass away. It’s a way to make sure they are financially secure, covering things like funeral costs, paying off debts, or even funding education. For more information about available plans, explore Top Life Insurance Options in South Africa.

For many families, life insurance offers peace of mind and stability during difficult times. Funeral costs, for instance, can be covered, easing the financial burden. You may also consider learning about other financial safety nets, such as Health Insurance in South Africa, which might include funeral benefits.

Common Types of Life Insurance

Term Life Insurance

- Provides coverage for a specific period (e.g., 10, 20, or 30 years).

- If you pass away during the term, your family receives a payout.

- It’s usually more affordable but doesn’t build cash value.

To learn more about term life policies in South Africa, check out Top Life Insurance Options in South Africa.

Whole Life Insurance

- Covers you for your entire life as long as you pay the premiums.

- Includes a savings component that builds cash value over time.

- Premiums are higher than term life insurance.

If you want to know more about the benefits of whole life insurance, visit Top Life Insurance Options in South Africa.

Universal Life Insurance

- A flexible policy where you can adjust your premiums and coverage.

- Also has a savings element that earns interest.

For guidance on flexible life insurance policies, explore Top Life Insurance Options in South Africa.

Life insurance is not just about protecting your loved ones financially, it’s about creating a lasting legacy. If you’re considering other forms of financial security for your family, such as educational funding, you can find helpful advice on platforms like Investopedia.

Leading Life Insurance Providers in South Africa

1. Discovery Life

Discovery Life is a life insurance product designed to provide financial security for you and your loved ones. It offers a variety of key features, benefits, and coverage options to suit different needs. Here’s a simple breakdown:

Key Features

- Comprehensive Cover: Protects against life’s uncertainties, including death, disability, severe illness, and income loss.

- Customizable Plans: Flexible policies that can be tailored to meet your individual or family needs.

- Health-Linked Benefits: Rewards for maintaining a healthy lifestyle, linked to Discovery Vitality.

Benefits

- Financial Protection: Ensures your family is financially supported if something happens to you.

- Living Benefits: Offers payouts for illnesses or disabilities to help you manage expenses during tough times.

- Rewards and Discounts: Enjoy discounts and rewards on premiums and other benefits for leading a healthy lifestyle.

Coverage Options

- Life Cover: Pays a lump sum to your beneficiaries in case of your passing.

- Severe Illness Cover: Provides financial support if you are diagnosed with a critical illness like cancer or a heart attack.

- Disability Cover: Offers payouts if you can no longer work due to a disability.

- Income Protection: Ensures you continue receiving an income if you cannot work due to injury or illness.

Discovery Life combines financial security with rewards for healthy living, making it a smart choice for both personal and family protection.

Life insurance is essential to protect your loved ones financially. Choosing the right policy depends on your needs, budget, and long-term goals.

2. Momentum Life

Momentum Life is an insurance provider offering life cover plans to protect you and your loved ones financially in case of unexpected events. Here’s a simple breakdown:

Plans and Premiums

- Life Cover: Provides a lump sum payout to your family if you pass away.

- Disability Cover: Offers financial support if you become disabled and can’t work.

- Critical Illness Cover: Helps with medical costs if you’re diagnosed with a serious illness.

- Flexible Premiums: You can choose a plan that fits your budget, with options to adjust your premiums as your needs change.

Additional Perks

- Momentum Multiply: A rewards program that gives discounts on fitness devices, gym memberships, and other lifestyle benefits.

- Health and Wellness Tools: Access to online health assessments and support to improve your well-being.

- No Paperwork Hassles: Easy online applications and quick claims processing.

Momentum Life helps you plan for the future while enjoying extra benefits today!

3. Old Mutual Life

When it comes to choosing life insurance, flexibility and customization can make all the difference. Old Mutual Life understands that everyone’s needs are unique, which is why they offer flexible options to suit a variety of lifestyles and financial goals.

Why Flexibility Matters

Life is full of changes. Whether you’re starting a family, building a business, or planning for retirement, your financial needs evolve. Old Mutual Life’s flexible plans allow you to adjust your coverage as your circumstances change. You can increase, decrease, or adapt your policy without needing to start over, saving you time and money.

Tailored to You

With Old Mutual Life, you don’t get a one-size-fits-all solution. Instead, you can customize your plan to fit your specific requirements. For example:

- Choose Your Coverage Amount: Decide how much you want your policy to cover, whether it’s to secure your family’s future or pay off debts.

- Add-on Benefits: Include additional features like critical illness cover or income protection to give yourself extra peace of mind.

- Flexible Payment Terms: Select a payment schedule that works for you, from monthly to annual premiums.

Who Can Benefit?

Old Mutual Life’s flexible options are ideal for:

- Young Professionals: Starting a career and need basic coverage? Keep it simple and affordable.

- Families: As your family grows, you can expand your coverage to provide for your loved ones.

- Entrepreneurs: Secure your business while ensuring your personal finances are protected.

- Retirees: Customize plans to focus on leaving a legacy or covering unexpected expenses.

The Old Mutual Promise

Old Mutual Life is committed to providing solutions that adapt to your life’s journey. With decades of experience, they’ve built a reputation for trust and reliability, ensuring that your loved ones are cared for when they need it most.

Make Your Move

Don’t settle for rigid insurance plans that don’t fit your lifestyle. Explore Old Mutual Life’s flexible options today and find a plan that evolves with you. After all, life isn’t one-size-fits-all and your life insurance shouldn’t be either.

Visit Old Mutual Life to learn more about their customizable plans and take the first step toward securing your future.

Factors to Consider When Choosing Life Insurance

Life insurance is an important way to protect your loved ones financially when you’re no longer around. But with so many options available, how do you choose the right one? Check out our comprehensive guide to life insurance options in South Africa for insights. Here are three key factors to think about when selecting a life insurance plan.

1. Premium Affordability

Life insurance is only helpful if you can afford to keep it active. When choosing a plan, look at how much you’ll need to pay each month or year (called the premium). Make sure it fits your budget, not just now but in the long run. It’s better to choose a plan with slightly lower coverage that you can sustain than to risk losing your policy because of high premiums. Use this budgeting tool to estimate what you can afford.

2. Coverage Benefits

Not all life insurance policies offer the same level of protection. Some cover basic death benefits, while others include additional perks like critical illness cover, funeral benefits, or education funds for your children. Think about your family’s future needs and choose a policy that provides the right balance of benefits. Read more about health insurance in South Africa for related coverage options. Remember, the goal is to ensure your loved ones are financially secure.

3. Claims Process and Reputation

A life insurance policy is only as good as the company behind it. Research the insurer’s reputation, especially when it comes to paying claims. Look for reviews or testimonials to see how quickly and fairly they handle claims. For a list of reliable insurers, explore our top life insurance options in South Africa. You can also verify reputations on trusted platforms like the Financial Sector Conduct Authority (FSCA). A smooth and reliable claims process will give your family peace of mind during a difficult time.

Choosing the right life insurance requires careful consideration of your financial situation and future needs. By focusing on affordability, coverage, and the company’s reputation, you can make a decision that protects your loved ones when they need it most.

Health Insurance Options in South Africa

When it comes to taking care of your health, having the right financial support is essential. Health insurance helps you manage medical costs, giving you peace of mind when facing unexpected health challenges.

But what exactly is health insurance, and how does it differ from medical aid? Let’s break it down.

Difference Between Medical Aid and Health Insurance

Many people confuse medical aid with health insurance, but they are not the same. Here are the key differences:

Medical Aid

- Comprehensive Cover: Medical aid is a regulated system designed to cover a wide range of medical expenses, including doctor visits, hospital stays, chronic medication, and sometimes even dental or optometry services. For those considering health insurance alternatives, explore our guide on Health Insurance in South Africa.

- Monthly Contributions: Members pay monthly premiums based on the plan they choose. Plans range from basic hospital cover to comprehensive benefits. If you’re comparing medical aid options with life insurance, check out our article on Top Life Insurance Options in South Africa.

- Regulated Benefits: Medical aid schemes in South Africa are bound by the Medical Schemes Act, which ensures that certain prescribed minimum benefits (PMBs) are covered. If you’re planning your overall financial security, understanding car insurance is equally essential, visit our overview of Best Car Insurance in South Africa.

Health Insurance

- Fixed Payouts: Health insurance provides a set amount of money to help with medical expenses, such as hospital admissions or specific illnesses.

- Limited Scope: It is more focused on covering certain events, such as accidents, critical illnesses, or hospital stays, rather than day-to-day medical needs.

- Flexible Usage: The payout can often be used for any purpose, not just medical expenses.

In simple terms, medical aid offers broader medical care, while health insurance focuses on financial support for specific health events.

Importance of Medical Cover in South Africa

South Africa’s healthcare system is divided into public and private sectors. Public healthcare can be overcrowded and under-resourced, while private healthcare offers high-quality services at a cost. This makes medical cover crucial for the following reasons:

- Access to Quality Healthcare: With medical aid or health insurance, you can access private hospitals and specialists, ensuring better and quicker treatment when you need it. For more on the importance of health insurance in South Africa, check out Health Insurance in South Africa.

- Financial Protection: Medical emergencies, such as accidents or severe illnesses, can result in high medical bills. Having cover prevents these costs from causing financial stress. You can explore different insurance options in South Africa through guides like Best Car Insurance in South Africa and Best Travel Insurance in South Africa to ensure comprehensive protection.

- Chronic Illness Management: Medical aid schemes often include benefits for managing chronic conditions, ensuring you get the necessary medication and treatments without additional costs.

- Peace of Mind: Knowing that you are covered for unforeseen health issues allows you to focus on recovery rather than worrying about expenses.

- Tax Benefits: In some cases, medical aid contributions can reduce your taxable income, providing an additional financial incentive. This can be an essential part of your overall financial planning.

Health insurance and medical aid both play an essential role in securing your health and finances. Understanding their differences and benefits can help you make the best choice for your needs. In South Africa, where healthcare costs can be high, having the right medical cover is not just a luxury but a necessity for protecting yourself and your family. For more about health and financial protection, refer to articles like Top Life Insurance Options in South Africa.

Top Health Insurance Options in South Africa

1. Discovery Health

When it comes to health insurance, Discovery Health offers a variety of plans to cater to different income levels. Whether you’re starting your career or already well-established, Discovery Health has something for everyone, ensuring access to quality healthcare when needed most.

Plans for Different Income Brackets

Discovery Health understands that people have different financial situations, so they offer plans that are flexible and affordable.

- Entry-Level Plans: These are perfect for younger individuals or those starting their careers. These plans offer basic coverage at a lower cost, helping you manage essential health needs without stretching your budget too much.

- Mid-Range Plans: If you’re in the middle of your career or have a growing family, mid-range plans provide more comprehensive coverage. These plans cover a wider range of healthcare services and have a higher benefit limit, giving you peace of mind when it comes to medical costs.

- Premium Plans: For higher earners, Discovery Health offers premium plans that provide extensive coverage, including access to top-tier private hospitals and specialists. These plans are designed to provide the highest level of care, making sure you and your family are well taken care of.

Network Hospitals and Healthcare Providers

One of the standout features of Discovery Health’s plans is the network of hospitals and healthcare providers you can access. Depending on the plan you choose, you may be required to use a network of approved providers, which helps keep costs down.

- Network Hospitals: Discovery Health partners with hospitals across the country to offer quality care at lower prices. Depending on your plan, you may need to use specific hospitals within the network to get the full benefits of your coverage.

- Healthcare Providers: Discovery Health also works with a network of doctors, specialists, and healthcare professionals. Using network providers means you’ll get the most out of your plan’s benefits, saving you from high out-of-pocket costs.

Discovery Health offers a range of plans suitable for different income levels, ensuring that everyone can access essential healthcare. Whether you need basic coverage or premium healthcare services, Discovery Health has an option for you. By choosing a plan that fits your budget and using network hospitals and providers, you can ensure that you and your family stay healthy without breaking the bank.

2. Momentum Health

Momentum Health is a health insurance provider that gives you the flexibility to choose a plan that suits your needs. Whether you’re looking for basic coverage or a more comprehensive option, they offer different plans to cater to a variety of budgets and lifestyles. This means you can select a plan that fits your personal health needs and financial situation.

One of the standout features of Momentum Health is its wellness benefits and discounts. By being a member, you can access a range of wellness programs that promote a healthy lifestyle. These include discounts on fitness gear, healthy food, gym memberships, and even wellness check-ups. It’s a great way to save money while taking care of your health.

With Momentum Health, you’re not just covered in case of illness – you’re also encouraged to live a healthier life with the added benefits of discounts and wellness support.

3. Medshield

When it comes to health insurance, finding the right plan that fits your budget and provides the coverage you need is essential. Medshield offers a range of affordable health insurance plans tailored to meet various needs. Whether you’re looking for basic coverage or more specialized options, Medshield has something for everyone.

Specialist Cover for Peace of Mind

Medshield understands that healthcare needs can vary, which is why they offer plans with specialist cover. This means you can get the treatment you need from professionals, ensuring you receive high-quality care when it’s most important. Whether it’s for a specific condition or a general health concern, Medshield’s specialist cover ensures you’re in good hands.

Network Options to Save Costs

Medshield also offers network options, which can help you save on healthcare costs. By using their network of trusted healthcare providers, you can access services at a lower rate, making your health insurance more affordable without compromising on care.

If you’re looking for a health plan that’s both affordable and comprehensive, Medshield could be the perfect option for you. With specialist cover and flexible network choices, Medshield makes it easier to take care of your health without breaking the bank.

Factors to Consider When Choosing Health Insurance

When selecting health insurance, it’s important to consider several factors that can affect both your health and your wallet. Here are three key things to keep in mind:

1. Premium Rates

Premium rates are the monthly payments you make to your health insurance provider. It’s crucial to choose a plan that fits your budget. However, don’t just settle for the cheapest option. Sometimes, lower premiums mean fewer benefits or higher out-of-pocket costs when you need care. Make sure the premium matches the level of coverage you need.

2. Access to Private Healthcare Providers

The health insurance plan you choose should give you access to the healthcare providers you prefer. Some plans allow you to visit any doctor or specialist, while others limit you to a network of providers. If you have specific doctors or hospitals you’d like to use, check if they’re included in the network of your insurance plan.

- For more on health insurance options in South Africa, check out Health Insurance in South Africa.

3. Medical Savings Accounts and Out-of-Pocket Expenses

Medical savings accounts (MSAs) can be a helpful way to save for future medical expenses. These accounts allow you to set aside money tax-free for healthcare costs. Consider exploring different health insurance options in South Africa to find coverage that suits your needs. Additionally, consider the out-of-pocket expenses, such as co-pays, deductibles, and coinsurance. Even if your premium is low, high out-of-pocket costs can add up quickly, so it’s important to understand what you’ll pay when you need care.

Choosing the right health insurance involves looking at both the costs and the coverage options to make sure it’s the best fit for you and your family. By weighing these factors, you can make a more informed decision. You may also want to explore top life insurance options to ensure your loved ones are covered in case of unexpected events.

Top Travel Insurance Options in South Africa

Travel insurance is a helpful way to protect yourself during your trip, offering coverage for unexpected situations. It can cover things like trip cancellations, where you get your money back if you have to cancel your trip due to emergencies. If you’re interested in the best car insurance in South Africa, you can explore options here. It also provides protection in case of medical emergencies while traveling, helping with hospital bills or doctor visits. Learn more about health insurance options in South Africa here. If your luggage is lost or delayed, travel insurance can help replace your items or cover the cost of essentials. This type of insurance gives you peace of mind, knowing you’re covered for many of the unexpected challenges that can come up while traveling.

Leading Travel Insurance Providers

1. Travel Insurance Consultants (TIC)

When planning a trip, travel insurance can offer peace of mind, and Travel Insurance Consultants (TIC) is a trusted name in the industry. TIC provides various types of coverage to make sure you’re protected while you’re away from home. Let’s take a look at what they offer.

Coverage Types

TIC offers a range of travel insurance coverage options, including:

- Trip Cancellation: If you need to cancel your trip due to unexpected events, this coverage helps you recover some or all of your expenses.

- Medical Emergencies: If you get sick or injured while traveling, TIC offers coverage for medical expenses, including hospital stays and doctor visits.

- Baggage Protection: If your luggage gets lost, damaged, or stolen, this coverage helps you replace your belongings.

- Travel Delay: If your flight is delayed or canceled, TIC can provide compensation for accommodation and other costs.

- Personal Liability: If you accidentally cause harm to someone or damage property, this coverage can protect you from financial loss.

Value-Added Services

Apart from their standard coverage options, TIC also provides valuable additional services to enhance your travel experience:

- 24/7 Assistance: TIC offers around-the-clock support for emergencies, helping you find a doctor or deal with any unexpected issues.

- Global Network: They have a global network of medical providers, ensuring that you can access the help you need, wherever you are.

- Travel Alerts: TIC keeps you informed of any travel disruptions, such as strikes or natural disasters, that could impact your trip.

With TIC, you can travel with confidence knowing that you have comprehensive coverage and extra services to back you up when needed. Whether you’re going on a short business trip or a long holiday, they’ve got you covered!

2. Oneplan Travel Insurance

When it comes to protecting yourself while traveling, Oneplan Travel Insurance offers comprehensive travel plans to ensure you’re covered from start to finish. Whether you’re going on a holiday, business trip, or even a weekend getaway, their plans have you covered for a range of situations, from medical emergencies to trip cancellations.

What makes Oneplan stand out is the ability to customize your benefits. You can choose what you need based on the type of trip you’re taking and what matters most to you. This flexibility allows you to tailor your coverage to your personal needs, giving you peace of mind wherever you go.

With Oneplan Travel Insurance, you’re not just getting basic coverage – you’re getting the protection you need, when and where you need it, all while keeping things simple and hassle-free.

3. Sanlam Travel Insurance

Traveling can be exciting, but it also comes with risks. That’s where Sanlam Travel Insurance comes in to give you peace of mind, whether you’re traveling locally or internationally.

Coverage for Both International and Local Travel

Sanlam Travel Insurance offers protection for both international and local trips. Whether you’re heading overseas for a holiday or taking a short business trip within the country, Sanlam has you covered.

Benefits for Families and Groups

Traveling with family or friends? Sanlam provides special benefits for families and groups, ensuring that everyone stays protected during the trip. This includes coverage for medical emergencies, lost luggage, cancellations, and more, tailored to suit the needs of larger groups or families.

With Sanlam Travel Insurance, you can enjoy your trip without worrying about the unexpected.

Factors to Consider When Choosing Travel Insurance

When planning a trip, travel insurance is a smart choice to help protect you from unexpected situations. Here are some important factors to keep in mind when selecting the right travel insurance:

- Coverage for Emergency Medical Expenses

It’s crucial to ensure your insurance covers emergency medical costs while you’re traveling. This includes hospital visits, doctor consultations, and treatment for accidents or illnesses that may happen during your trip. Without this coverage, medical bills abroad can be extremely costly. - Trip Cancellation Policies

Life is unpredictable, and sometimes you may need to cancel your trip unexpectedly. A good travel insurance plan should offer trip cancellation coverage, which reimburses you for non-refundable expenses, such as flight tickets or hotel bookings, if you have to cancel due to illness, emergencies, or unforeseen events. - Baggage Loss and Travel Delays

Losing your luggage or experiencing delays can ruin your travel experience. Travel insurance can help cover the cost of replacing lost baggage and provide compensation for extended delays, giving you peace of mind in case something goes wrong during your journey.

By considering these factors, you can choose a travel insurance policy that gives you the protection you need for a stress-free trip.

Top Car Insurance Options in South Africa

Car insurance is a type of protection that helps cover the costs if your car is damaged or stolen. In South Africa, car insurance is essential for safeguarding yourself against unexpected expenses related to accidents or damage to your vehicle. You can explore the best car insurance in South Africa to find the right coverage for your needs.

Types of Car Insurance

- Comprehensive Insurance: This type of insurance covers you for almost any situation, including accidents, theft, and damage to your car. It also covers damage caused to other vehicles or property. It’s the most complete coverage and offers peace of mind.

- Third-Party Insurance: This is the minimum level of insurance required in South Africa. It covers damage you cause to other people’s cars or property but doesn’t cover any damage to your own car.

- Third-Party Fire and Theft Insurance: This type is similar to third-party insurance, but with the added benefit of covering damage or loss due to fire or theft. It doesn’t cover other types of damage to your car.

Legal Requirements in South Africa

In South Africa, it is not legally required to have car insurance. However, it’s mandatory to have third-party insurance if you’re driving on public roads. This ensures that if you cause damage to someone else’s property or vehicle, you’re covered. While comprehensive insurance is not a legal requirement, many people choose it for better protection.

Leading Car Insurance Providers

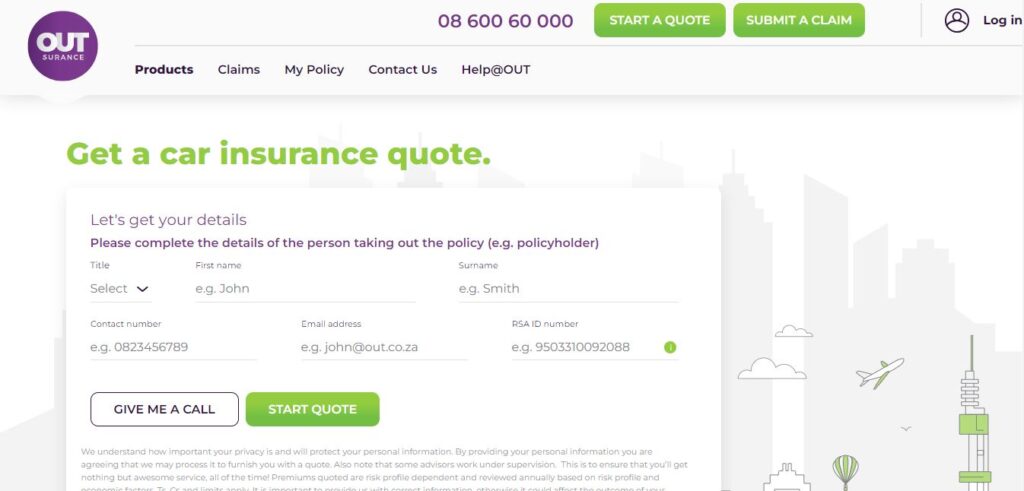

1. Outsurance

Outsurance offers a variety of insurance options that can be customized to suit your specific needs. Whether you’re looking for car, home, or life insurance, Outsurance gives you the flexibility to choose the coverage that fits your lifestyle. You can also take advantage of tailored packages that offer great value at competitive prices.

Roadside Assistance and Added Benefits

One of the standout features of Outsurance is their roadside assistance service. If you ever find yourself in a difficult situation, like a flat tire or car breakdown, Outsurance has your back with quick and reliable help. Plus, they offer additional benefits to make your insurance experience even better, ensuring peace of mind wherever you go.

With Outsurance, you get more than just standard coverage – you get personalized protection with added perks that can make all the difference.

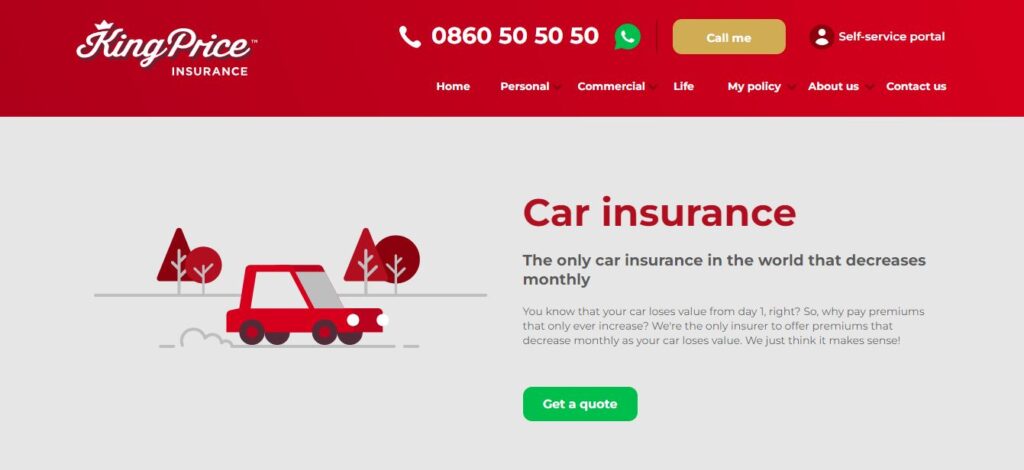

2. King Price Insurance

When it comes to getting the best deal for your insurance, King Price Insurance offers great value for money. They focus on providing affordable premiums without compromising on coverage.

One of the standout features is their customizable excess and coverage options. You can tailor your policy to suit your needs, choosing a higher or lower excess depending on your budget. This flexibility allows you to control your costs while ensuring you get the protection you need.

Whether you’re looking for car, home, or other types of insurance, King Price Insurance makes it easy to find a plan that fits your financial situation and personal preferences. So, if you’re looking for an insurance company that balances quality and affordability, King Price is definitely worth considering.

3. Santam

Santam is known for offering a wide range of insurance cover options to suit different needs. Whether you’re looking for car, home, or life insurance, Santam provides comprehensive plans that ensure you’re well-covered.

One of the things that sets Santam apart is their reputation for outstanding customer service. They go the extra mile to help their clients, offering support and guidance when you need it most. With Santam, you can expect a reliable, friendly service that aims to make the insurance process as smooth and stress-free as possible.

If you’re looking for peace of mind with your insurance, Santam’s combination of comprehensive cover and excellent customer service makes them a top choice.

Factors to Consider When Choosing Car Insurance

When choosing car insurance, there are a few important factors you should think about to make sure you’re getting the best coverage for your needs.

Premiums and Excess Options

The premium is the amount you pay for your insurance policy. It’s important to choose a premium that fits within your budget. However, you should also look at the excess – the amount you’ll have to pay when making a claim. A higher excess could lower your monthly premium, but it might cost you more if you need to make a claim.

For more information on the best car insurance options in South Africa, check out Best Car Insurance in South Africa.

Customer Service and Claims Process

Great customer service is key when it comes to car insurance. You want to choose a provider that’s easy to contact and has a smooth claims process. Check online reviews and ask others about their experiences to ensure you’ll get the support you need when the time comes.

Added Benefits like Roadside Assistance

Some car insurance policies offer extra benefits, such as roadside assistance, which can help you if your car breaks down. Consider whether these added benefits are worth the extra cost and if they provide real value to you.

Choosing the right car insurance is about balancing cost, coverage, and customer support. Take your time to review your options and pick a policy that suits both your needs and your budget.

Conclusion

When it comes to choosing the right insurance, there are many options available for life, health, travel, and car coverage. Each type of insurance offers unique benefits, so it’s important to take the time to compare different plans and find the one that best fits your needs. For a comprehensive comparison of car insurance options in South Africa, check out this guide to the best car insurance.

Remember, everyone’s situation is different. What works for someone else might not work for you. That’s why it’s crucial to assess your own needs carefully before making a decision. You can explore some of the best health insurance options in South Africa by visiting this health insurance guide.

Take the time to explore all your options, and you’ll be more confident in choosing the right insurance plan to protect yourself and your loved ones. If you’re considering life insurance, refer to this article on the top life insurance options in South Africa. Additionally, if you’re traveling, it’s wise to look into travel insurance for peace of mind during your trips. Learn more about the best travel insurance options in South Africa here.