Saving money is one of the most important financial habits to cultivate, but choosing the right savings account is just as critical. South African banks offer various types of savings accounts, each with different interest rates, fees, and access options, making it essential to select an account that aligns with your goals.

In this blog, we will provide insights into the best savings accounts available in South Africa, compare the benefits of each, and help you make the right choice.

Why Choosing the Right Savings Account Matters

A good savings account should offer a balance between interest rates, accessibility, and low fees. Whether you’re saving for an emergency fund, a future purchase, or a long-term goal, the right account can make a big difference in how quickly your money grows.

Key Considerations:

- Interest Rates: Higher interest rates mean better returns on your savings.

- Fees: Look for accounts with low or no monthly fees.

- Accessibility: Determine how quickly you can access your money if needed.

- Deposit Terms: Some accounts offer flexible terms, while others require fixed-term deposits.

Top 6 Savings Accounts in South Africa

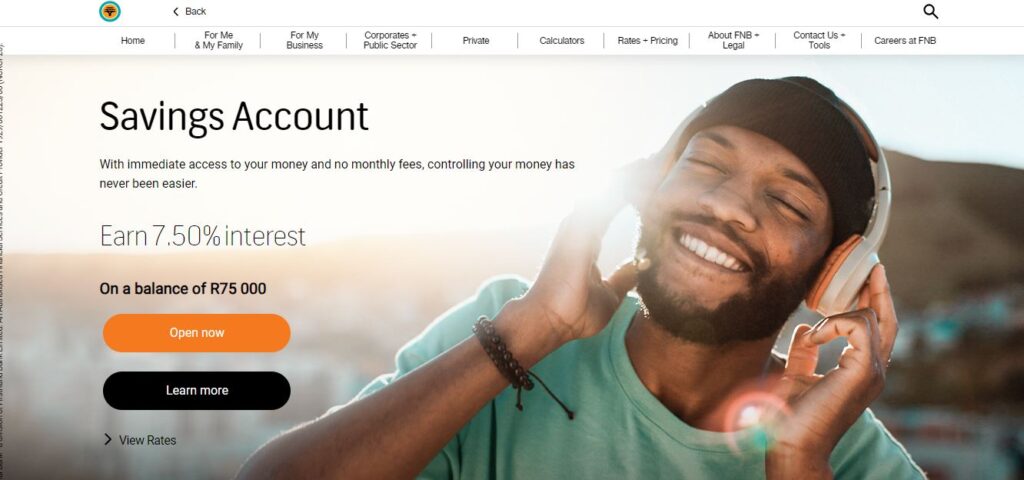

1. FNB Savings Account

FNB offers multiple savings account options, including the FNB Savings Pocket and 32-day notice accounts. These options cater to different needs, from emergency funds to long-term savings.

Interest Rates: FNB offers tiered interest rates based on the balance of the account.

Key Benefits:

- Flexible access to your funds.

- No monthly fees for some accounts.

- The option to link your savings account to your transactional account for easier transfers.

Why Choose FNB?

FNB’s savings accounts are perfect for individuals who need easy access to their savings while still earning interest. The lack of monthly fees makes it a cost-effective option for long-term savers.

2. Capitec Global One Savings Account

Capitec Bank has made waves in South Africa for offering simple and affordable banking options. Their Global One savings account is ideal for everyday savers.

Interest Rates: Between 2.75% and 6.90%, depending on the account balance.

Key Benefits:

- Competitive interest rates, even on low balances.

- Low banking fees and no hidden charges.

- Multiple savings plans within one account, allowing you to save for different goals at once.

Why Choose Capitec?

Capitec’s Global One account is known for its transparency and ease of use. With high interest rates on even small balances, it’s ideal for anyone looking to maximize returns on their savings without high fees.

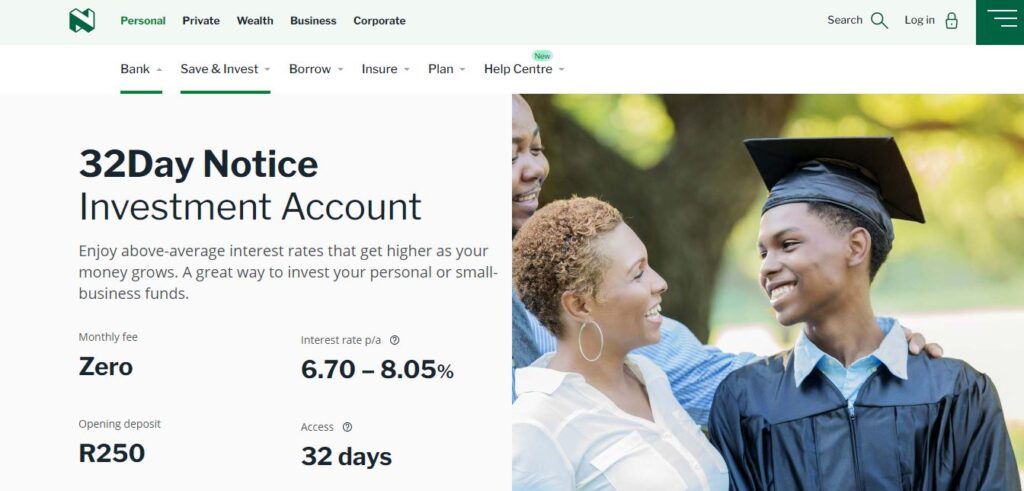

3. Nedbank 32-Day Notice Account

Nedbank offers a solid 32-day notice account, making it an excellent choice for people looking to save money they won’t need immediately.

Interest Rates: Up to 8.05% for higher balances.

Key Benefits:

- Competitive interest rates that increase with higher balances.

- No monthly fees.

- Access to funds after 32 days’ notice, which encourages disciplined saving.

Why Choose Nedbank?

This account is perfect for savers who don’t need immediate access to their money and are looking for a slightly higher interest rate in exchange for the notice period.

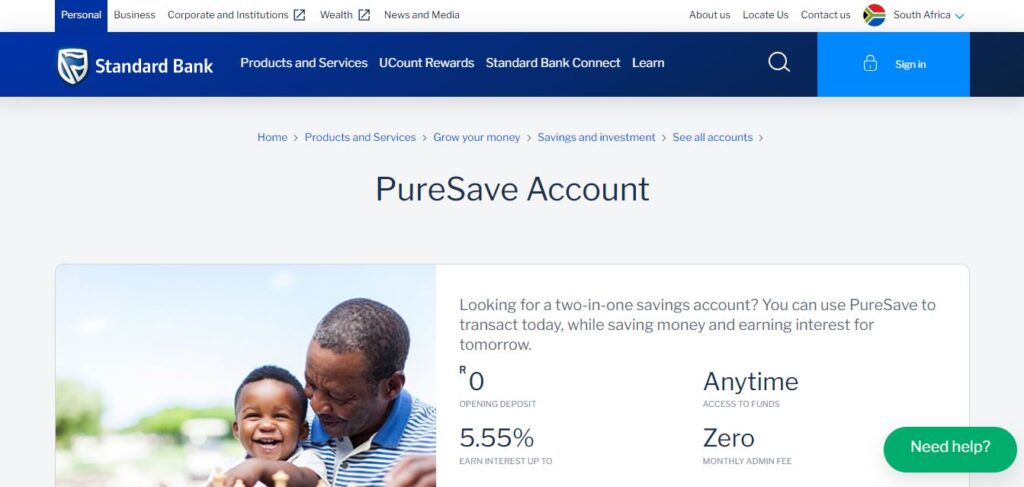

4. Standard Bank PureSave

Standard Bank’s PureSave account is designed for customers who want to save regularly while still having access to their money when needed.

Interest Rates: Variable, depending on the account balance.

Key Benefits:

- No minimum balance required to earn interest.

- Flexible access to funds.

- Low monthly fees.

Why Choose Standard Bank?

This account is perfect for individuals who want flexibility in accessing their savings without sacrificing interest. The low monthly fees make it accessible for everyone, regardless of their financial situation.

5. ABSA Dynamic Fixed Deposit

ABSA’s Dynamic Fixed Deposit account offers high-interest rates for individuals willing to lock their money away for a fixed term.

Interest Rates: Up to 8.70%, depending on the term and deposit amount.

Key Benefits:

- Fixed terms ranging from 8 days to 5 years.

- Higher interest rates for longer terms.

- No monthly fees.

Why Choose ABSA?

For individuals who have a lump sum of money they won’t need in the short term, ABSA’s fixed deposit offers some of the highest interest rates in South Africa.

6. African Bank Fixed Deposit

African Bank has become popular for its high fixed deposit interest rates, making it a great option for long-term savers.

Interest Rates: Up to 12.80% for long-term fixed deposits.

Key Benefits:

- Guaranteed high returns for long-term deposits.

- No monthly fees.

- Safe, reliable savings option with guaranteed returns.

Why Choose African Bank?

African Bank’s fixed deposit offers unbeatable interest rates for those willing to commit their funds for a longer period. It’s ideal for those looking to grow their savings rapidly with no risk.

How to Choose the Best Savings Account for You

Choosing the right savings account depends on your financial goals, savings habits, and how much access you need to your funds. Here are the key factors to consider:

1. Interest Rates

Higher interest rates mean more money earned on your savings. Compare the rates of different accounts, and consider whether they are fixed or variable.

2. Account Fees

Many savings accounts come with monthly fees, which can eat into your savings. Look for accounts with low or no monthly fees, like Capitec or FNB.

3. Access to Funds

Some accounts, like the Nedbank 32-day notice account or ABSA’s fixed deposit, limit your access to funds in exchange for higher interest rates. If you need quick access to your money, accounts like FNB’s Savings Pocket or Capitec’s Global One are more flexible.

4. Deposit Requirements

Some savings accounts, especially fixed deposit accounts, require a minimum deposit to open or to earn higher interest rates. Make sure the account you choose matches your current savings balance.

5. Additional Features

Many banks offer additional features like linked transactional accounts, mobile apps, and budgeting tools. These can make it easier to manage your savings and track your progress.

The Importance of Saving

Building a healthy savings habit is crucial for financial security. Whether you’re saving for an emergency fund, a big purchase, or long-term investments, the right savings account can help you reach your goals faster.

By comparing the best savings accounts in South Africa, you can find one that matches your financial goals and helps you make the most of your money.

Final Thoughts: Best Savings Accounts in South Africa

There’s no one-size-fits-all savings account. FNB, Capitec, Nedbank, Standard Bank, ABSA, and African Bank all offer strong options, but the best choice depends on your personal needs. Whether you’re looking for high-interest rates, no monthly fees, or easy access to your savings, the accounts listed above provide some of the best solutions in South Africa.

Take the time to assess your financial situation, compare interest rates and fees, and make a decision that will maximize your savings potential.